The Princeton Review recently released the findings of their annual survey of college applicants and parents discussing their perspective on the admissions process. When asked about their biggest concerns about college, the biggest worry was the debt students and their families will take on to pay for a degree. Parents and students prioritized overall “fit” and a match with the student’s career interests when choosing a college. These results fit with the perceived biggest benefit of a college education – a better job and higher income. Given this information, communications about the opportunities CTE provides in these categories would be very beneficial as students begin to plan for their futures.

New America also just released national survey data about perceptions of higher education. This survey contains some promising data for community colleges. 64 percent of respondents believe that two-year community colleges “are for people in my situation.” More people (80%) believe that two-year community colleges prepare people to be successful. This is higher than four-year public (77%) four-year private (75%) and for-profit (60%). Additionally, 83 percent of respondents believe that two-year community colleges contribute to a strong workforce. This is higher than four-year public (79%) four-year private (70%) and for-profit (59%).

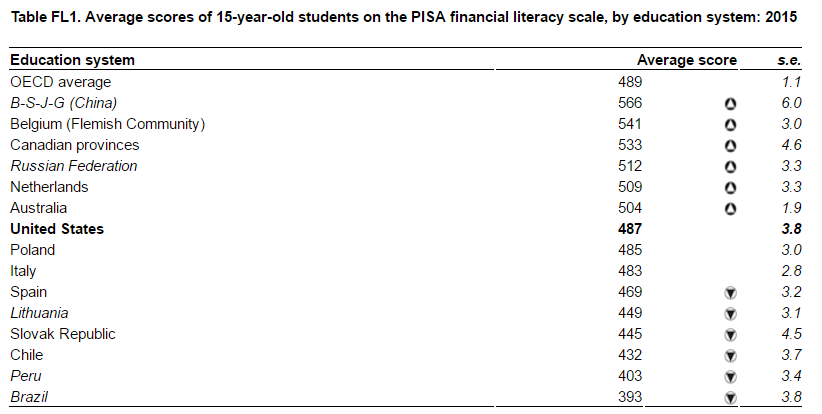

U.S. Teens Fall Behind International Peers in Financial Literacy Exam

The results of the 2015 Program for International Student Assessment (PISA) exam on financial literacy have been released, and the results are less than promising. The financial literacy exam has been administered twice now to a select number of participating Organization for Economic Cooperation and Development (OECD) countries. US teens scored an average score of 487, two points below the international average. In 2012, American students received average scores of 492, while the OECD average that year was 499.

Though the U.S. has scored close to the OECD average in both exams, the results are still concerning, given that an average score signifies that one in five American teens do not meet the financial literacy benchmark, and are therefore unprepared for the complex financial decisions that come with choosing postsecondary and career options. This data becomes more concerning when examined through the lens of socioeconomic status. Students from lower-income families were less likely to score high marks on the exam, indicating that schools are not doing enough to close gaps in knowledge.

Odds and Ends

What is a community college degree worth? A research brief from CAPSEE aims to answer that very question. The report examines independent state evaluations and finds that, on average, the quarterly earnings for men and women earning associate degrees are $1,160 and $1,790 higher than non-completers respectively. Further, the study finds that degrees earned in vocational fields, as opposed to arts and humanities, yield higher earnings, with degrees in health-related fields the most lucrative.

Speaking of skills learned in college, a recent Gallup poll — conducted for the Business-Higher Education Forum — finds that, while 69 percent of employers will prefer candidates with data science and analytics skills by 2021, only 23 percent of college and university leaders say their graduates will learn those skills. The report provides eight strategies educators and employers can use to help close the skills gap.

Ashleigh McFadden, State Policy Manager